Child Tax Credit 2022

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The future of child tax credit payments in 2022 and beyond may be dependent Democrats swaying two centrist members of their own party.

2021 Child Tax Credit Advanced Payment Option Tas

The child tax credits are worth up to 3600 per child in 2021 and are automatically issued as monthly advance payments of up to 300.

Child tax credit 2022. The full credit is accessible to two-parent families with up. Increases the tax credit amount. Advance Child Tax Credit Payments in 2021.

This is because the IRS bases the monthly amounts on your 2019 or 2020 tax return. In 2021 and 2022 the average family will receive 5086 in coronavirus stimulus money thanks to the expanded child tax credit. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Business Insider reports that half of the amount owed to families through the program will be given in the monthly checks. Lapsing child tax credit threatens 2022 disaster for Democrats if safety net bill fails. While the October payments of the Child Tax Program have been sent out many parents have said they did not receive their September check.

Makes the credit fully refundable. However accepting the money as an advance could mean a tax shock in 2022 after the IRS has processed your 2021 tax return. The new child tax credit will go into effect for the 2021 taxes.

Receives 3600 in 6 monthly installments of 600 between July and. Even if you dont owe taxes you could get the full CTC refund. The Biden administration is thrilled with the rollout of advance child tax credit CTC monthly payments that began flowing in July but that enthusiasm isnt shared by tax return preparers.

The child tax credit provides a financial benefit to Americans with qualifying kids. If your child turns 18 this year then they are not eligible for the monthly Child Tax Credit explained Congressman Steve Cohen. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. However the American Rescue Plan did provide for a one-time credit of 500 for dependent children aged 18 and for dependent full-time college students aged between 19 and 24. For tax years before 2021 the IRS allowed you to claim up to 2000 per child under 17.

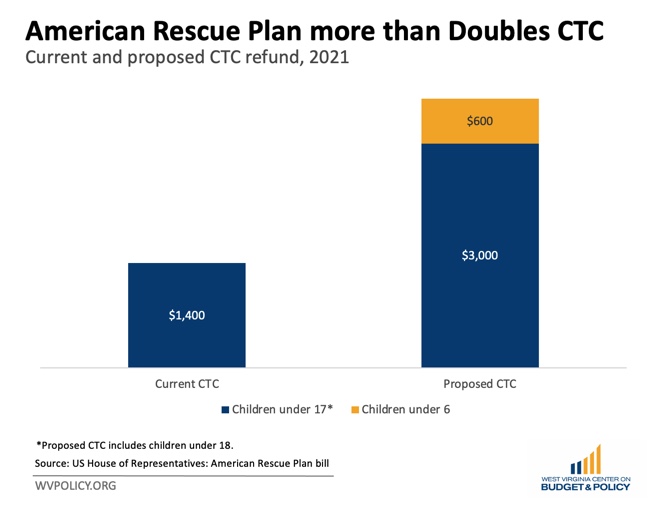

Advance Child Tax Credits Hurtling Toward 2022 Train Wreck. The American Rescue Plan made a few key changes to the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a 600 bonus. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

So if you dont receive all of the child tax credit you will get some back in 2022. Those payments however are set to end in December though if some lawmakers have the way the money will keep flowing in 2022. Here is what you need to know about the future of the child tax credit in 2022.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. Getty Images NEXSTAR House Democrats unveiled a sweeping proposal Monday for tax hikes on big corporations and the wealthy to fund President Joe Bidens 35 trillion rebuilding plan as Congress.

Child Tax Credit Update Portal. The tax credits maximum amount is 3000 per child and 3600 for children under 6. The partys only realistic hope of keeping those payments going is to pass Bidens social spending bill.

Total Child Tax Credit. Increased to 7200 from 4000 thanks to the American Rescue Plan 3600 for each child under age 6. Although the child tax credit is not available at the moment there are other tax provisions that may affect your 2020 tax return.

The expanded child tax credit or CTC is a cornerstone in President Bidens Build Back Better agendaan immediate method for reducing child poverty that has produced tangible results. This money was authorized by the American Rescue Plan Act which. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. The significant changes made to the Child Tax Credit has been a welcome relief for many families across the United States of America with it having been favourably altered in March 2021 as part. In January 2022 the IRS will send families that received child tax credit payments a letter with the total amount of money they got in 2021.

You will claim the other half when you file your 2021 income tax return. The enhanced tax credit in place now offers 3600 per child younger than six and 3000 per child up to 17 over the course of a year. CHILD TAX CREDIT AGE CUT OFF Age is determined on December 31 2021.

Currently the expanded child tax credit provides 3600 for each. But the remainder will be given at tax time in 2022. THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it.

When you file your tax return in 2022 you will get to claim up to 3600 in child tax credit. The main updates for the Child Tax Credit for 2022 are as follows. Removes the minimum income requirement.

Stimulus Checks And Expanded Tax Credits How Much You Could Get

Child Tax Credit Schedule How Many More Payments Are To Come Marca

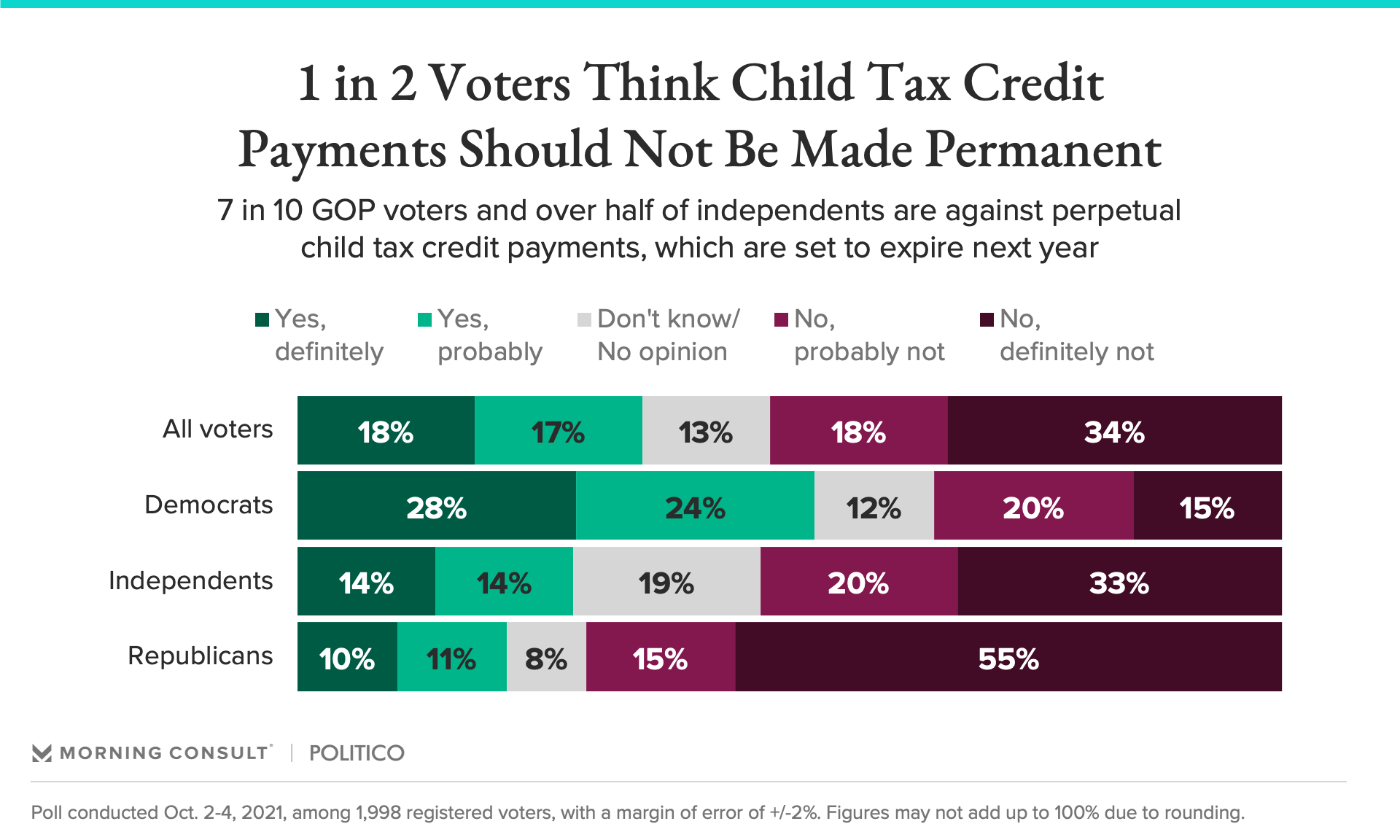

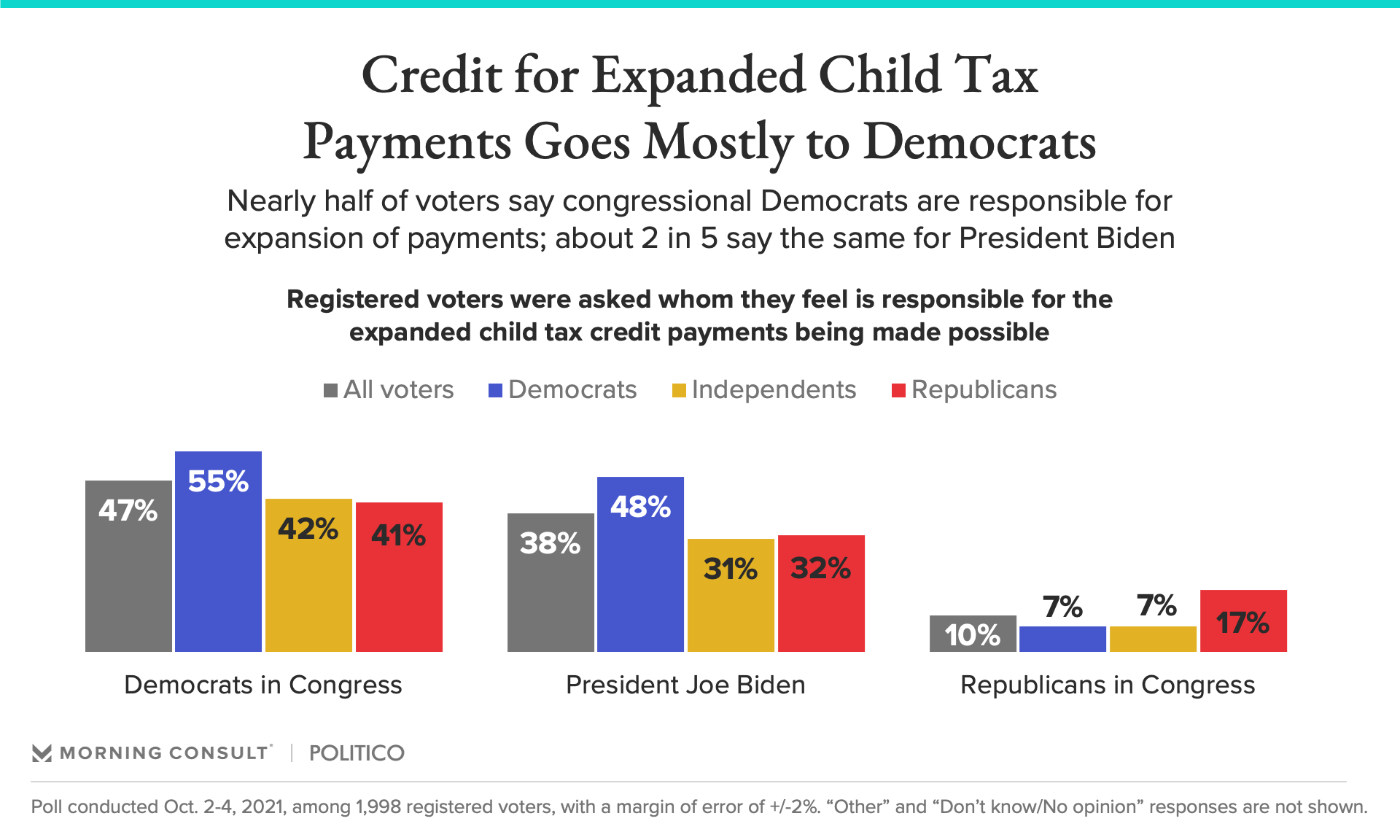

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

The Last 2 Child Tax Credit Payments Are Fast Approaching What To Know Now Cnet

Stimulus Checks And Expanded Tax Credits How Much You Could Get

The Last 2 Child Tax Credit Payments Are Fast Approaching What To Know Now Cnet

Child Tax Credit Here S When You Ll Get The August Payment Cbs News

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

Federal Solar Tax Credit 2021 How Does It Work Sunpro Solar

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

The Last 2 Child Tax Credit Payments Are Fast Approaching What To Know Now Cnet

Here S When You Can Expect The October Child Tax Credit Payment

No Goodies And Small Tax Cuts What To Expect In Budget 2022

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Fourth Stimulus Check Summary News 13 October As Com

Changes To Child Tax Credit Under American Rescue Plan Will Help 400 000 Kids In West Virginia West Virginia Center On Budget Policy

Some Families Missing Out On Child Tax Credit

Child Tax Credit How It Works Under The New Stimulus Bill

Rating: 100% based on 788 ratings. 5 user reviews.

James Kopp

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Child Tax Credit 2022"

Post a Comment